Power Purchase Agreement vs Outright Purchase

- Power Purchase Agreement vs Outright Purchase

- What is a Power Purchase Agreement (PPA)?

- What is an Outright Purchase?

- Power Purchase Agreement Vs Outright Purchase

- Advantages of a Power Purchase Agreement

- Disadvantages of a Power Purchase Agreement

- When to Consider an Outright Purchase

- When to Consider a Power Purchase Agreement

- ROI and Lifetime Value Considerations

- Conclusion: Power Purchase Agreement vs Outright Purchase

- Your Next Step

- Frequently Asked Questions

Power Purchase Agreement vs Outright Purchase

In our previous blog, we explained PPAs – how they work, what they mean and why choose one. In this article, we’ll cover the differences between PPAs and outright purchase, to help you and your organisation decide which option is best for you.

When an organisation decides to invest in solar PV, the conversation quickly turns to how to pay for it. Solar panels will pay for themselves by providing free electricity over a 30 year lifetime, but organisations may not have the capital available.

For many, the choice comes down to two options:

- Outright purchase: paying for the system in full up front

- Power purchase agreement (PPA): paying only for the electricity generated, over a set term

Both can deliver strong returns on investment. The best choice will depend on your organisation’s budget, risk aversion, and sustainability goals.

Read about other funding options we can support you with.

What is a Power Purchase Agreement (PPA)?

A power purchase agreement is a contract between your organisation and a solar provider. The provider funds, installs, owns, and maintains the solar PV system on your site.

You agree to buy the electricity the system generates at a fixed, usually lower-than-grid rate, for an agreed period (often 10–25 years). At the end of the term, ownership of the system typically transfers to your organisation, giving you decades of free, clean energy.

PPAs are common in the commercial, industrial, and public sectors because they remove the need for up-front capital.

What is an Outright Purchase?

An outright purchase means you buy the solar PV system yourself, covering the full installation cost from day one.

You own the asset immediately and keep all the electricity it generates without paying a provider. You also take on responsibility for maintenance, repairs, and performance risk.

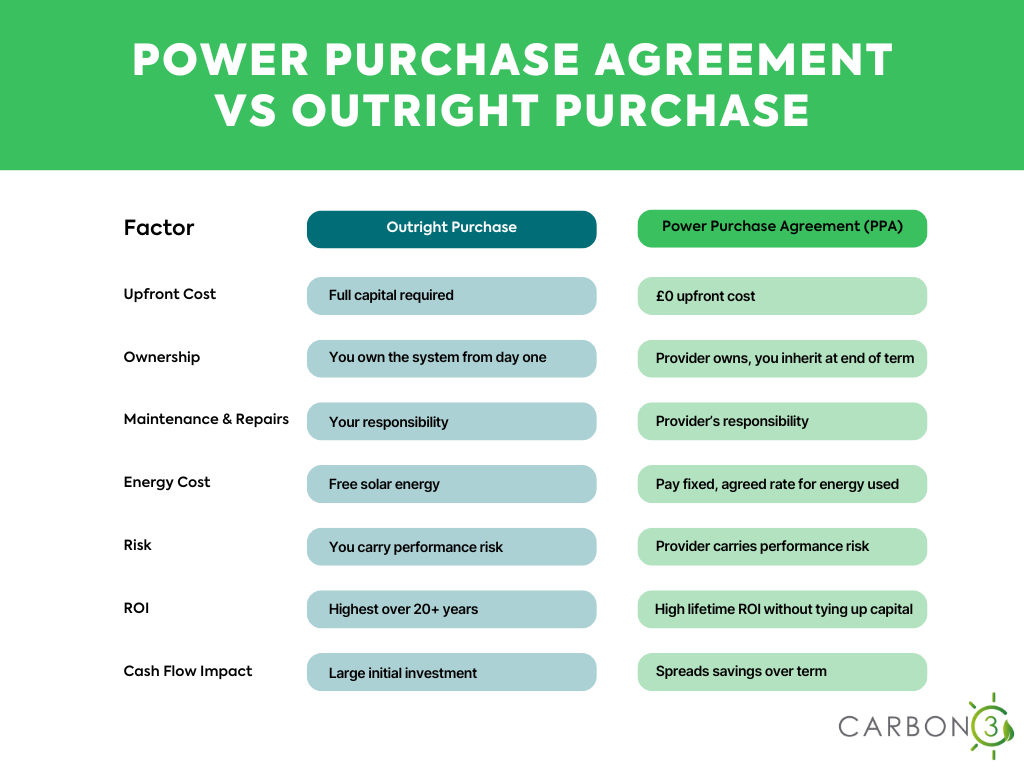

Power Purchase Agreement Vs Outright Purchase

Advantages of a Power Purchase Agreement

A PPA can be an attractive option for organisations that want the benefits of solar without the upfront cost. Key advantages include:

- £0 capital expenditure

No large up-front payment means your cash flow stays intact for other strategic investments. - Immediate energy savings

PPA rates are usually lower than grid prices, so savings start from the day the system is switched on. - Predictable energy costs

Fixed pricing protects you from unpredictable wholesale electricity price increases. - No maintenance responsibility

The provider handles all maintenance, performance monitoring, and repairs throughout the term. - End-of-term ownership

At the end of the PPA, you typically take ownership of the system, enjoying many more years of free electricity.

Disadvantages of a Power Purchase Agreement

While PPAs can deliver strong lifetime returns, there are some potential downsides to consider:

- Long-term contract commitment

You’ll be tied into an agreement for 10–25 years. Ending it early can be difficult or costly. - Total lifetime cost

Over the term, you may pay more than you would have with an outright purchase, depending on energy usage, contract length, and market prices. - No immediate asset ownership

Until the contract ends, the system is owned by the provider, which may affect how it’s accounted for in your organisation’s asset register. - Contract complexity

PPA agreements can be detailed and legally binding. You’ll need to fully understand the terms before committing.

When to Consider an Outright Purchase

An outright purchase may be more suitable if:

- You have available capital to invest without affecting other priorities

- You want to maximise savings over the system’s lifespan

- You’re comfortable managing ongoing maintenance and repairs

- You want the asset on your balance sheet immediately

When to Consider a Power Purchase Agreement

A PPA may be better if:

- You want to avoid upfront capital expenditure

- You need immediate savings without large cash outflows

- You prefer to outsource maintenance and performance risk

- You want predictable energy pricing over the long term

ROI and Lifetime Value Considerations

Outright Purchase:

- Offers the highest ROI once the system has paid for itself (often 6–10 years)

- After payback, you benefit from decades of free electricity

PPA:

- Offers high lifetime ROI without tying up capital

- Allows you to redirect funds to other strategic projects while still benefiting from solar savings

- Can be especially attractive during periods of high energy market volatility

Conclusion: Power Purchase Agreement vs Outright Purchase

Choosing between a power purchase agreement and an outright purchase comes down to more than just numbers. It’s about your organisation’s budget, appetite for risk, and long-term energy strategy.

Advantages of a power purchase agreement include no upfront cost, immediate savings, and no maintenance responsibility. Disadvantages of a power purchase agreement include long contract terms, possible higher lifetime costs, and delayed asset ownership.

An outright purchase offers the highest possible long-term savings but requires a significant capital investment and the willingness to take on maintenance.

Your Next Step

If you’re weighing up power purchase agreement vs outright purchase for your solar project, we can model the options side-by-side so you can make an informed decision.

Get in touch with Carbon3 to see what’s possible for your site.

Frequently Asked Questions

1. Who can benefit from a Power Purchase Agreement?

PPAs are often ideal for organisations that:

- Want to reduce energy costs without capital investment

- Prefer to outsource maintenance and performance responsibility

- Need predictable energy pricing for budgeting purposes

- Have sustainability and net zero targets but limited funding

2. Do I need financial advice before deciding?

Yes, as we are not regulated to provide financial advice, we recommend discussing the numbers with your finance team or a qualified advisor. Our role is to help you understand the technical, operational, and sustainability implications of each option so you can make an informed decision.

3. Are there other options available for funding?

Yes, solar panels can be funded by other means. You could be eligible for government funding, or you could secure a loan to finance the array. Take a look at other funding options available to you here.